IRA vs Roth IRA - Bro

I recently had a reader question if a Roth IRA or a Traditional IRA is better. Of course the answer is (not) simple! All info contained in this blog post is to the best of my knowledge (and research). Please do your own homework before you make any money moves.

Update: Jared makes a very good argument as to why the initial example is flawed in the comments below. Please take to time to read his comment or visit his post. The original logic is still sound in that it is possible to end up paying higher taxes in retirement but your retired income would have to be drastically higher or the government would need to raise taxes significantly.

EX: If a married couple makes $100,000 a year but plan on spending $200,000 a year in retirement their marginal tax rate while working is still 22%. When they retire and withdraw $200,000 from their Roth IRA they will pay 0% in taxes instead of the 24% they would have paid if they had put their money in a traditional IRA.

Step 0: What is a Roth or Traditional IRA?

Roth IRA: The money that you put in there is already taxed and is taken out without paying any more taxes*.

EX: If you make 50,000 as a couple it would cost you $6,470 ($970 in taxes) to make the $5,500 contribution. When you get to retirement you will owe no taxes on what you take out.

Traditional IRA: The money that you put in there is before taxes and when it is taken out it is taxed.

EX: You make your $5,500 before you pay any tax on it. When you withdraw the money you pay taxes on it as if it were normal income. In this case if you were to withdraw $5,500 after the age of 60 and your income was 50,000 as a couple you would pay 15% tax or $825.

There is no difference in the amount of money you get at retirement if your income bracket is the same at the time of contribution and at the time of withdrawal.**

Step 1: What is your income?

Then you can contribute to either a Roth IRA or a Traditional IRA***. Keep reading to learn more.

Then you can only contribute to a Roth IRA. Note: If you are married and only one of you works a Spousal IRA might be an option to get around this limit and invest $5,500 in a Traditional IRA. A spousal IRA is an advanced money move so be sure to do your research.

My income is over $120,000 for a single person or $189,000 for a married couple:

Then you can contribute to a Roth IRA using a backdoor. Please be sure to do your research as this is a more advanced money move.

Step 2: Do you think your tax bracket (income) will go up or down in retirement?

I think my tax bracket (income) will go down in retirement:

If you think your tax bracket will go down in retirement then an traditional IRA is for you. Your money will be sheltered until you hit that lower tax bracket.

EX: If a married couple makes $100,000 a year but only plan on needing $50,000 in retirement then their marginal tax rate while working is 22%. When they retire and withdraw $50,000 from your IRA or 401K you will be taxed at 11.2%

I think my tax bracket (income) will go up in retirement:*****

If you think your tax bracket will go up in retirement then a Roth IRA is for you. Pay your taxes now and you will be able to withdraw your money without having to pay the higher taxes on it.

Update: Jared makes a very good argument as to why the initial example is flawed in the comments below. Please take to time to read his comment or visit his post. The original logic is still sound in that it is possible to end up paying higher taxes in retirement but your retired income would have to be drastically higher or the government would need to raise taxes significantly.

Step 3: Will you need short term access to your money?

Yes:

Then you should probably put your money in a normal taxed account. If you want the tax benefits but still like the idea of having access to your money then a Roth IRA is for you. Any contributions can be removed without penalty.

No:

Then either account will work for you.

Step 4: Do you plan to retire early (before age 59.5)?

Yes:

Traditional IRA’s can be hard to get money out of in the short term but if you have 5 years notice you can use a traditional IRA to Roth IRA conversion. In the early retirement space this is used to access money from an 401K or traditional IRA. Due to this technique if you need long term access to your money a IRA is better due to the fact you can access your contributions and earnings.

No:

Then either account will work for you.

Step 5: What about a 401K, HSA, or other?

401K: A 401K is your best option up to your companies match. After that it is just like a Traditional IRA except for a few small details. First, you have no control over the provider so the fees on your money could be higher. Second, it can be difficult to use your money while still employed. After you are unemployed a 401K can be converted to a traditional IRA and moved wherever you like.

HSA: The HSA is an amazing savings account assuming you keep track of your medical expenses. Fund your HSA before any traditional IRA or Roth IRA. It combines the best aspects of both accounts.

Other: Many other account types are out there. 457 and 403b are plans for certain government employees that is like a 401K. 529 plans can be used to save for college but are not very useful for anything besides that.

* There is nothing that would prevent the government from trying to tax Roth IRAs down the road. That being said if they ever did try to tax it I think they would have a lot of angry taxpayers on their hands.

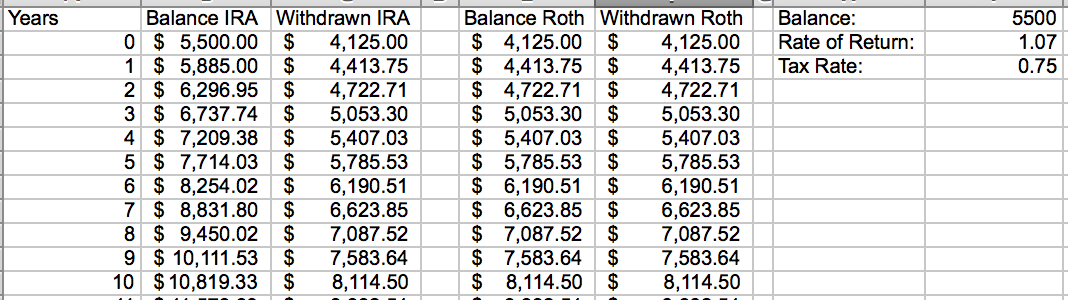

**A Roth IRA would allow a person to save more money due to the fact your Roth IRA contribution already has its taxes paid. This is the reason the roth column in the example has a starting contribution of $4,125

*** You are allowed to contribute to an IRA even if you are over these income levels but you will not get any tax advantage. Kind of defeats the purpose in my opinion.

****The IRS will allow a partial contribution if your income is slightly above these numbers.

*****Government spending tends to go up so it is quite possible tax rates will go up as well.

Thank you again to Jared. Marginal tax rate vs total tax rate is something that trips me up. Examples have been updated or replaced to reflect the correct math.

Thank you again to Jared. Marginal tax rate vs total tax rate is something that trips me up. Examples have been updated or replaced to reflect the correct math.

Great explanation of the difference between the two accounts!

ReplyDeleteOne thing I think you may be missing is that even with increased spending in retirement, it is often possible that a traditional account will come out being better than a Roth account. Using your example above: The couple working and making $100,000 per year in the 22% marginal bracket would be saving 22% in taxes on their contributions due to this money coming off the top of their total income while working. In retirement (assuming no additional sources of income) when they withdraw the $200,000 they need to cover their spending, the money withdrawn from the traditional account will have to fill up the lower tax bracket before ever making it to the 24% marginal bracket. Starting at the bottom tax bracket and working up means that the $200,000 withdrawn in retirement would be taxed at an effective rate of 14.9%. That means that even with double the spending in retirement this couple would still come out ahead using a traditional account during their working years.

I've written several different posts on this with much more detail than I'm explaining here. This one is probably the most comprehensive and can hopefully clarify my point further. https://fifthwheelpt.com/2017/10/07/roth-accounts-are-a-scam-for-those-seeking-fire/

Thank you Jared. I have added an update above the example. Marginal tax rates get ya every time.

ReplyDelete